Bookkeeper Job Description - Day in the Life of a Bookkeeper

Have you wondered what exactly a bookkeeper does each month? What is a bookkeeper’s job description? Well, in this article, I share with you my daily work-from-home schedule as a bookkeeper and go through two of my bookkeeping clients’ workloads. I’ll show you how I input checks, categorize expenses, record income, and more.

I’ve compiled a few days of work for you so you can get a good glimpse of how I set up my bookkeeping work. I am a busy mom, so I have learned how to be flexible with where I fit in my work based on my kids’ school and activity schedule or any other pressing momming things I need to do throughout the week.

For the most part, I do work every Thursday from 9 a.m. to 2:30 p.m. This is when I get a bulk of my bookkeeping work done. On a normal week, I will work about 10 hours, so the other 4-5 hours I fit in another day or two where I can. We all are in different stages of life, so it’s encouraging to know that you can be flexible with your work week and create the schedule that will work for the season you’re in!

Hopefully this will help you understand a bookkeeper’s role more clearly if you’re thinking of starting a bookkeeping business, if you’re already a bookkeeper, if you’re looking to hire a bookkeeper, or if you’re just curious about what a bookkeeper does each month.

Watch the video here, or keep reading!

Morning Working Time - Yearly Bookkeeping for a Client

Throughout the morning I was working on QuickBooks Online, doing the yearly bookkeeping for one of my small clients. She doesn’t hire me every year to do her books, but she did hire me for this year and last.

This client has a fairly typical set up for small businesses. She has one bank account and one credit card to keep track of. I had everything feeding into QuickBooks all year because that’s how I had it set up in the past.

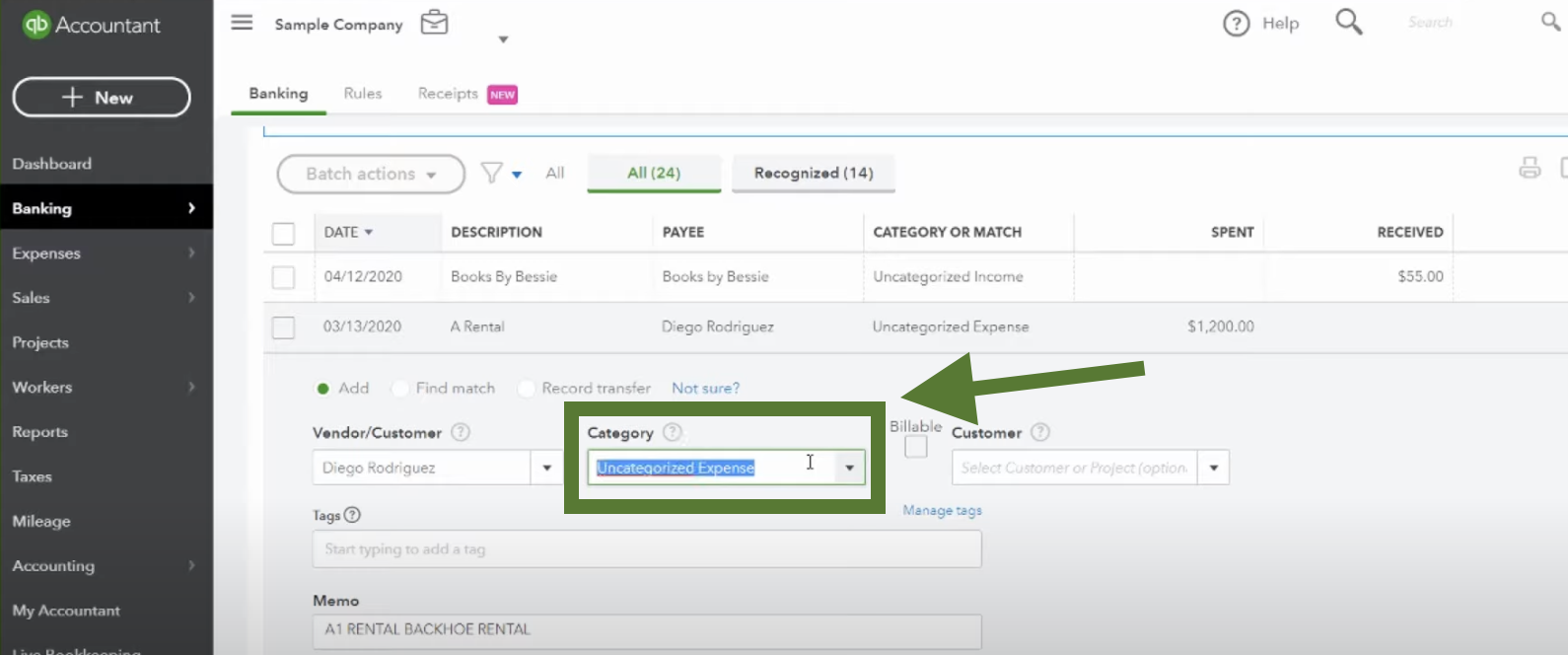

Categorizing business expenses

I categorized all of the expenses on both her bank account and her credit card.

Organizing chart of accounts

I did some work in her chart of accounts as well to make her expenses categories more clear. She is a florist, and I wanted to separate her flower costs from her basic tools, such as vases and clippers.

I also split out the office supplies from the office software supplies. In the chart of accounts, usually these are together, but I prefer to separate them. I do this because I think of office supplies as pencils, pens, staplers, and so on, but software seems like a different category to me. This is a personal preference, but I just wanted to share what I do in case it helps clarify anything for you.

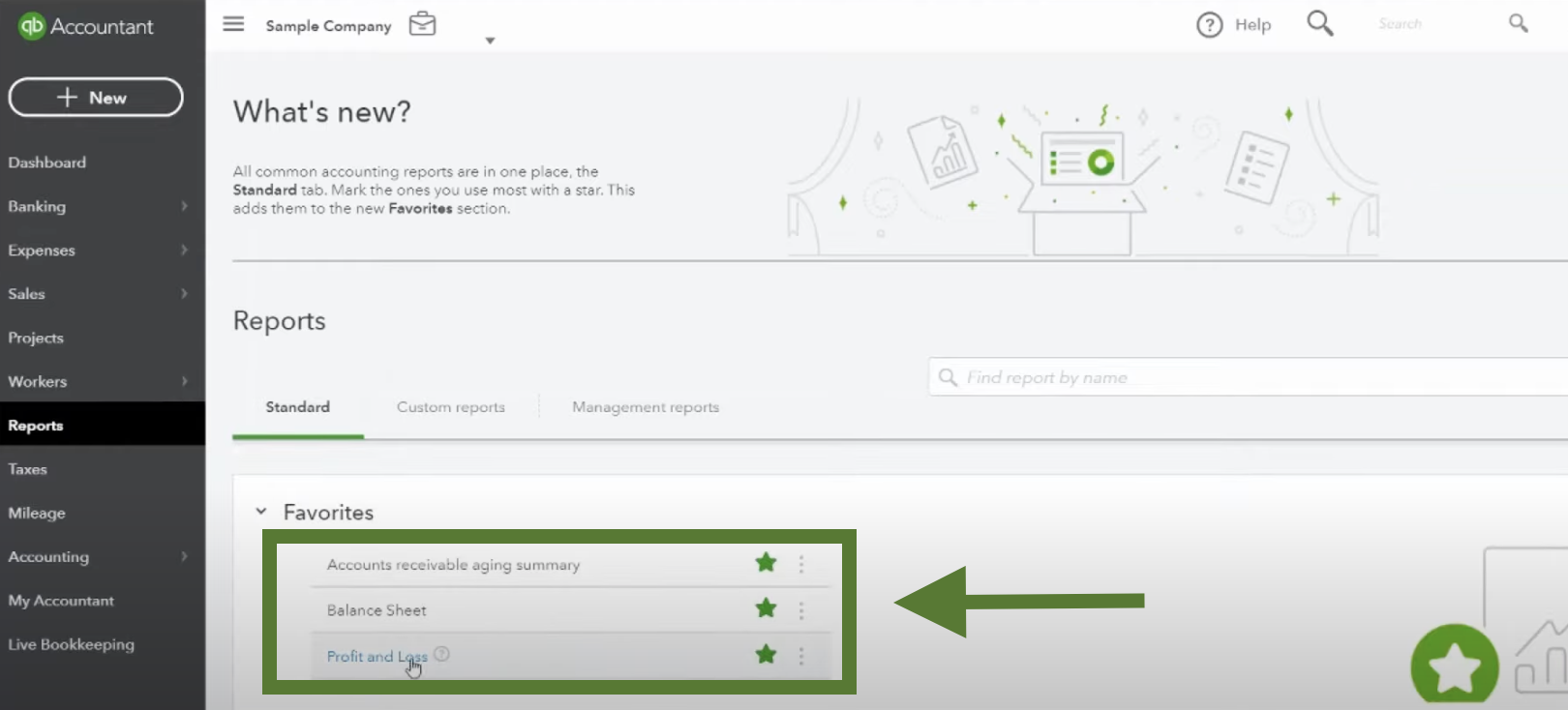

Checking profit and loss for the year

After I categorized her transactions, I pulled up her profit and loss for the year. Because this is a fairly small business, I clicked on the dollar amount in each of the categories to see what was contained in that category. I made sure everything made sense and that nothing seemed to be categorized wrong.

Reconcile the bank account for each month

For this client, I plan to reconcile her bank account at the beginning of the year and again at the end. This is a process in QuickBooks where you check that your records match what is in the bank. For bigger clients I would do this monthly, but for this client, just once a year is sufficient (all the months are reconciled at the same time).

Meet with client to share updates and communication

I plan to meet up with my client after I finish reconciling her bank account to help her get the QuickBooks app set up on her phone so she is able to categorize the expenses herself. Her business is small enough that she is fully capable of doing that as a business owner.

I’ll also show her how to use the online receipt capture to help cut down on paper clutter. This client is very technologically savvy, so I’m sure she’ll be interested in simplifying her processes this way.

Free Download: Start a bookkeeping business

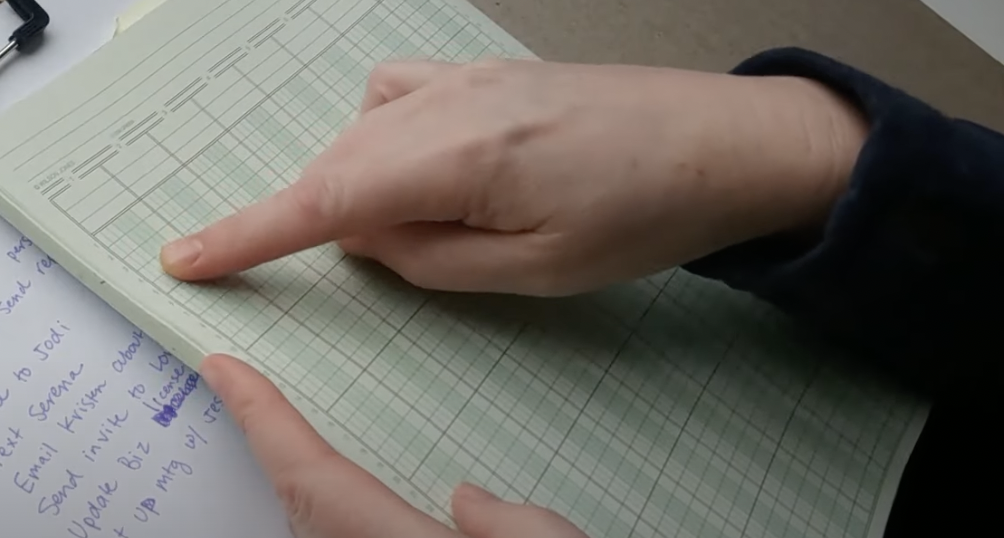

Creating and Organizing My Bookkeeping To-Do List

Earlier in the day I was working on my to-do list and organizing the tasks I needed to focus on first. Most of the time I use paper for this! I’ve learned that writing it out by pen has been helpful and simple for me to do.

Some bookkeepers love having a planner or an online task manager for their to-do lists, and that is perfectly fine too. Do what works best for you.

Today I wrote down everything I’m trying to accomplish in the next few hours before I pick my kids up from school.

The first three things are for a specific client. I need to:

Input checks and match them to bank feed

Input income per person

Reconcile and send reports

Inputting checks and matching them to client’s bank feed

My client gives me paper check stubs. Before I connect them to the bank feed, I want to input each check first because it makes the process much easier.

I’ve mentioned before that I try not to deal too much with paper, but from this client in particular, I get these paper check stubs once a month. There are probably around 60 checks I need to input for him, and that is fairly typical each month. I usually go into the office once a month to pick them up, otherwise they will occasionally drop them off for me.

The first thing I do is put the check into QuickBooks. Then, once the check gets cashed, I see it in the QB “bank feeds” and I make sure the two match. This is a really great way to check that what you’ve input is correct.

Inputting income per person

My client receives money from his own clients, but he wants to also keep track of what each employee is making per client. He uses a paper ledger to keep track of this and records each employee’s name, how much they made, and which client it was for.

On the profit and loss statement, it will record the income, each employee, how much they made, and the total income for the company. Expenses will be listed below. What this does is give the owner more capability to see what each person is making within the firm.

Once everything feeds in from the bank, I go through the ledger and make sure it matches up with the deposits. This ensures all the income is accounted for.

Reconciling the bank account and sending reports

Once I finish inputting the checks, matching them to the bank feed, and inputting the income made per person, I finish by reconciling the bank account, getting the statement from the bank website, and then I am able to send reports to the owner.

For this client I send a profit and loss statement each month as well as one for the past three months so he can see month-to-month how the company is doing.

Free Workshop: Is bookkeeping right for me?

Other random to-do list items

The next things on my to-do list are:

Send invoice to Jodi - sometimes I get wrapped up in doing client work that I forget to keep up on the invoicing.

Text Serena - she is another bookkeeper from my area who found me on YouTube. We like to get together periodically to network and support each other. She’s also a little bit newer to bookkeeping, so I help answer some of her questions.

Email Kristin about spreadsheet - another client needs to send me a spreadsheet because I had some questions for her. I am waiting for her to get back to me on that, so this will be my quick reminder for her to see if it is ready for me.

Send invite to Lori - It is nearing tax season, so I have been communicating with all of my clients’ accountants to ensure they have everything they need. Lori is an accountant for one of my clients. This was the first time that Lori had used QuickBooks Online, so I added her to my QuickBooks account. Now that I added her, she will be able to go in and pull any reports she will need to prepare the client’s taxes.

Update business license - With the new year coming, I need to make sure I am current with my own local business license.

Set up meeting with Jessi - I told one of my clients I would give her a short tutorial in QuickBooks because she is doing much of it alone, and she is wanting to learn how to put her receipts into the system. I most likely will meet with her in person, as she is near enough to me, and I know her in my “real life.”

This to-do list is fairly typical for my work day. I usually do some client work and then some odds and ends, such as getting back to people and doing tasks for my own business.

I hope this helped you to get a glimpse inside what a typical bookkeeping day looks like for the solopreneur!

RELATED: What Does a Bookkeeper Do - Day in the Life Series