What Does a Month in the Life of a Bookkeeper Look Like? (Monthly Checklist)

Are you curious what a bookkeeper does each month?

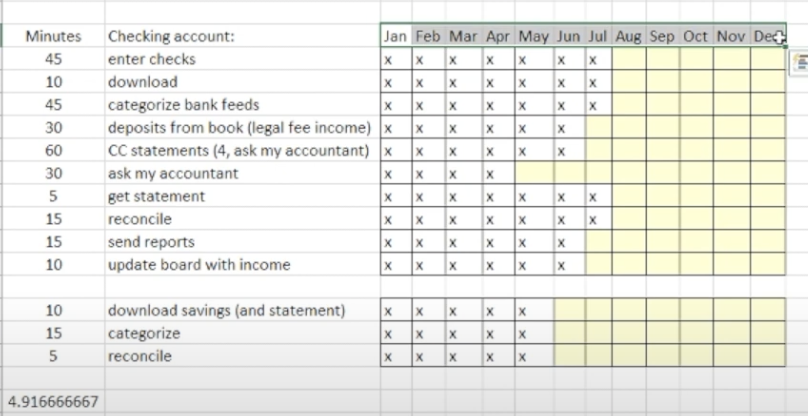

Tasks range from categorizing bank feeds to entering checks to reconciling and sending reports to the client. But what does this look like on a monthly basis? Today I’m going to share with you exactly what I do each month for one of my bookkeeping clients using my own checklist. This list has been helpful for me to keep up-to-date and on track with my client’s books.

Watch the video here or keep reading!

Create a Bookkeeping Checklist for Each Client

I’ve found that it works well to have a written log of each task I need to complete for each client. I created a checklist that works effectively for me to log the necessary items I need to remember. It’s important to create a system or checklist that will suit your own working needs.

Along the top of the spreadsheet are the months so I can easily see and check off that I’ve done everything I needed to that month for my client.

I also track the estimated minutes it takes me to do each task. If anything, I tend to overestimate just so I can get a good gauge for the time I’m spending. If I run into any snags or problems that will take me longer, then I can still know on average the time that it will take me to do any given task.

Bookkeeper Tasks in Checking Account

This particular client has two bank accounts: a checking and a savings account. The first ten items are in relation to their checking account.

Task 1: Entering Checks

The first thing I do each month for my client is enter any checks. It’s important to do this first so we can match what feeds into the bank account. This client works off paper checks, so every month I will pick up the check stubs and enter them into QuickBooks.

As a bookkeeper you don’t always have to do it that way, but it is best practice to enter checks before they show up in the bank feeds.

It takes me about 45 minutes per month to enter all the checks for this particular client.

RELATED: Paperless Bookkeeping

Task 2: Download Transactions from Bank Account

Normally, downloading transactions from the client’s bank account is a pretty simple task. However, this is my one client who doesn’t have that option. The company they bank with is a local chain and doesn’t link up to QuickBooks Online as of now.

The good news is that there is a pretty easy workaround to the task if your client’s bank account doesn’t hook up to QuickBooks either. In order to get the transactions, you can go to the bank, select the date range you want, download it, and then you can upload it into QuickBooks from there.

Most banks will automatically be in QuickBooks, but if they aren’t connected, there will be about eight or so steps you’ll need to take to get the necessary information input into QuickBooks. Thankfully, none of them take all that long.

The transaction downloading process takes me about ten minutes on average.

Task 3: Categorize Client Bank Feeds

The time that this task will take to complete depends on how many transactions your client has each month. This client has a few hundred transactions each month, and it takes me about 45 minutes to categorize the bank feeds.

QuickBooks will learn your transactions, so every time you get something from Comcast, for example, it knows to put it into a certain category. However, even with all that remembering and automation, it still requires me as a bookkeeper to go through and fine-tune everything.

Sometimes a transaction will come through and be categorized wrong, or maybe it’s a new vendor that they’ve never had before. In those examples, it requires me to use my knowledge to categorize each transaction accordingly. If it’s a new vendor, I will Google and try and figure out what it is and know where to categorize it, but if I can’t figure it out on my own, I will ask my client what they spent the money on.

Task 4: Deposits from Book

I need to wait on my client to give me the information for this task, so it doesn’t always happen as step four. My client wants to record how much money each person in the firm is making, and that is tracked on the profit and loss statement. They have a book where they record all that information, and then it comes to me, and I put it into QuickBooks.

At some point in the month, I need to get the deposit book from them so I can record all the income information for them.

RELATED: Day In the Life of a Bookkeeper

Task 5: Keeping Track of Credit Card Statements

My client’s credit card is hooked up to the bank account, but I get the credit card statement and am able to categorize all the transactions from there.

As you can imagine, when a client is spending a bunch of money on the credit card, it could be coming from multiple different categories. They could be buying supplies from Amazon, recording their utility bills, paying their health insurance, or a number of different transactions. You definitely want to make sure that each of those expenses go in the right categories and not just inputting it as one lump sum of a credit card payment like you’d see on the bank statement.

Inputting the deposits from the Income book and categorizing the credit card statements takes me roughly an hour and a half for this client and are probably the two most labor-intensive tasks part of this client’s workload. Much of the reason is because it is paper-based and not automated.

My client is happy with the flow of things, so we haven’t transitioned to a more automated system, but because of the extra paper it is more time-intensive than it probably needs to be.

Task 6: Use “Ask My Accountant” for Questions

Anything that I don’t know what it is goes into a category called, “Ask My Accountant.” I would email these transactions to my client or bring them when I meet with them. I do periodically meet with this client, and sometimes we tackle these questions at that meet up.

This task hasn’t been done in the past few months for this client because we don’t discuss them every month that we meet. I want to be respectful of their time, and it’s more efficient just to do a whole bunch of them at once.

Alternatively, I could also create a spreadsheet of these items and email it to them, especially if they are remote. When I do this task, it takes about a half hour of my time.

Tasks 7 & 8: Get Client’s Bank Statement & Reconcile Account

The next step is to get my client’s bank statement from the bank website and reconcile the bank account. Usually this task doesn’t take very long. All I need to do is log into the bank, get the statement, and reconcile the account.

Reconciling means matching what is in QuickBooks to what is in the bank account. As long as no major problems arise, reconciliation usually goes fairly quickly. You will need to get the end balance of the bank statement and put it into QuickBooks, make sure all the transactions are the same, and then hopefully it will equal out zero, which means everything is accounted for.

It usually takes me about five minutes to get the statement and about fifteen minutes or less to reconcile the account.

Tasks 9 & 10: Send Client Reports

After reconciling the bank account, I am able to pull reports for my client, such as the profit and loss statement comparing the last couple of months or the last year. You can send your client whatever other reports they want.

One of the extra reports my client wants is a running total of all income so he can see on an overarching scale how the business is doing.

I also just discovered this place with nice, helpful graphs for your client. I learned this from taking my QuickBooks Online recertification. If you are in QuickBooks and go to the left side to “overview” and then go to “business performance,” there are about ten graphs that you and your client may find really helpful. For example, one of them is a line plotting your net income for the year and comparing it to last year, and it can even compare it to other industries in the client’s area.

Figure out what the most important reports are for your particular client and ensure he gets them from you each month or quarterly.

Bookkeeper Tasks in Savings Account

I created a separate checklist for my client’s savings account because there are way fewer transactions each month in it, so I don’t feel the need to spend my time reconciling it every single month.

If there are only a few transactions, it is easy, yes, but the things don’t necessarily fit in. It would almost waste more of my time to log in, download and upload necessary statements, and reconcile the few transactions.

Because of this, I reconcile my client’s savings account every other month or quarterly.

The three tasks I do for the savings account are download the savings account transactions and statement, categorize them, and reconcile them. I basically do the same thing as I do with the checking account, but it’s on a much smaller scale.

This takes me around a half hour to do each time.

How Long Does it Take Me Each Month?

When I added up all the hours, it was around five hours total for the month. That is about perfect because I charge this client $250 a month, which works out to be about $50 an hour. That is about what my hourly rate is currently.

The good news is that as a fixed-rate client, if I get these tasks done in a shorter amount of time, I’m making a higher hourly rate. One of the questions I get a lot from other bookkeepers starting out is how much to charge clients.

I estimated the time it would take me based on the maximum amount of time it would take. Fixed-rate pricing is so much easier than an hourly rate, and this is a prime example of how it can benefit you as a bookkeeper. You know how much to charge, and your client knows what to expect.

Quick Tip

Along the bottom of my spreadsheet, I have a few extra tabs.

The first one is “bills,” which is any notes for myself about vendors that I don’t know. Sometimes there’s a vendor that has something tricky to remember or I don’t know where it goes, so I put notes in there about that.

The next two tabs are “pain points” and “goals,” and these track where I can be more efficient or the struggles I’m having in certain areas. It includes notes for things to talk to my client about and any questions I have about their books.

As I’m working and think of things, I have a designated place for notes and questions.