How Much Money Can Bookkeeping Businesses Really Make?

Have you been curious about what the standard income you can expect is when you start a bookkeeping business? Is a bookkeeping business profitable?

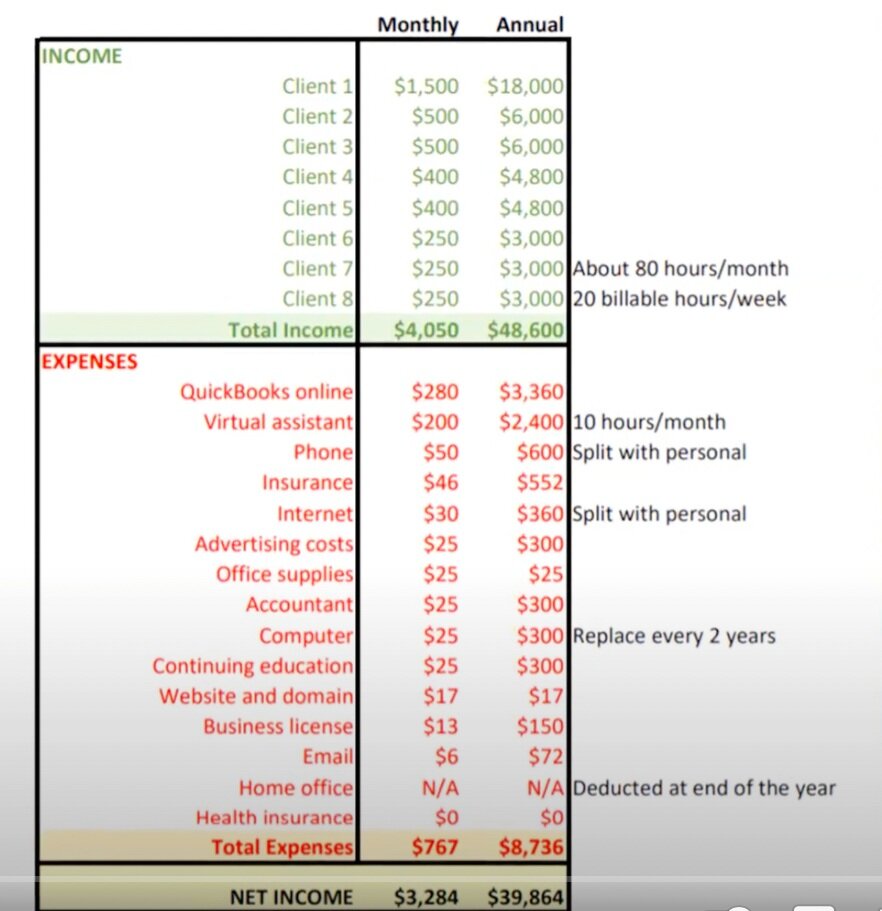

The good news is that bookkeepers can make a sizable income even with their ongoing monthly expenses. Today we’ll break down what a typical budget is for bookkeepers and all the expenses you can expect - from office supplies to a virtual assistant to your QuickBooks Online subscription for your clients.

I didn’t use my own bookkeeping income as the example for this breakdown because my business doesn’t have a typical bookkeeper feel. I also have my YouTube channel and some passive income, so I wanted to break down a typical bookkeeper income for you so you can have a better understanding of the income and expenses and true profit margins.

Watch the video here, or keep reading!

Typical Profit and Loss Statement for Bookkeepers

For this bookkeeper, I have her working half time, or about 20 hours a week. You definitely can be a full-time bookkeeper, but what I’ve found is that the bookkeepers I’ve interacted with most use it as a side hustle or a part-time job in conjunction with other revenue streams.

The profit and loss statement is broken up with two columns: monthly and annually. I did that so you could see the full picture, as some things make more sense monthly than they do annually.

When I created the fixed rates for these clients, I wanted it to add up to roughly $50 an hour. One thing to note as you’re figuring out what to charge is what tasks you are doing for each client and how much time each of those tasks typically take. It’s good to overestimate a little from what your average time may be on any given task. The last thing to decide is if you are happy working with the hourly rate that the fixed rate will average out to.

This bookkeeper has eight clients that are a variety of sizes. It’s important to understand what the differences are in clientele based on the size of their company and the number of accounts you are reconciling. With her biggest client, she works one day a week and charges $1,500 a month. She has a couple of clients who are charged $500 a month, a couple at $400, and a few at $250.

The work is broken down into about 20 hours of billable time each week or 80 hours per month. Of course, you may need to spend some time working on your own business, doing marketing, updating your website, or doing your own books.

With these eight clients, this bookkeeper brings in $4,050 every month.

What are a Bookkeeper’s Expenses Each Month?

A bookkeeper’s expenses each month are relatively low, which is why this career is so appealing to many who are looking for a part-time side hustle.

QuickBooks Software

The most expensive thing I could think of that bookkeepers need to spend is on QuickBooks software, which is a cornerstone of your bookkeeping business. You can charge your client for their subscription, but I personally like to add it into their bookkeeping plan with me.

This offering is attractive to clients so they don’t have to worry about keeping a subscription. Plus, as a bookkeeper, I get QuickBooks much cheaper for them than they would have otherwise. My ProAdvisor QuickBooks Online Plus subscription discount is $35 a month per client. So this bookkeeper who has eight clients would be spending $280 a month to hold their subscriptions.

RELATED: How to Pay for Client’s QuickBooks Online Subscriptions: Deals and Tips for Bookkeepers

Hiring a Virtual Assistant

Another expense a bookkeeper could have is hiring a virtual assistant to do some marketing, invoicing, answering emails, or other small tasks. This bookkeeper has a virtual assistant who works for her 10 hours a month at $20 an hour, which comes out to about $200 a month. One benefit to hiring a virtual assistant is that you can pass off any more automated tasks for you so you can focus on the actual books for your clients and increase your client base.

Phone, Insurance, and Internet

Bookkeepers use their phone for business, talking to clients, booking appointments, and so on. Most likely you’ll be using your regular cell phone as your business phone, so it’s used half the time for business, and half the time for personal matters. I budgeted $50 a month for phone expenses in this example.

Business insurance is important to keep your personal assets out of reach if a client is unhappy and takes legal action against you for any reason. The nice thing about insurance is that it is relatively inexpensive, and it covers what you need. I budgeted $46 a month for insurance.

Bookkeepers need quality internet connection, and once again, you’ll most likely be using it for both personal and business, so I estimated about $30 a month for business purposes.

Advertising costs and office supplies

I don’t really spend anything on advertising, but sometimes it is worth it to do. I budgeted $25 a month on advertising for this bookkeeper, as those costs truly are relatively low and only optional expenses.

All you really need for office supplies as a bookkeeper is a computer and maybe some paper and pencils. You may need to buy supplies such as ink here and there. We’ll budget $25 a month here, but the fact that all you really need is your computer makes bookkeeping such a great business!

Hiring an Accountant

As a bookkeeper, unless you are trained as an accountant as well, you will want to hire an accountant to do your own taxes each year. You’ll be looking at roughly $300 a year, which, broken down, is $25 a month.

Replacing Your Computer

A computer is a bookkeeper’s largest asset because you can do everything you need to from it. This is something I suggest you save money for each month in case you need to replace your old computer down the road. I’m estimating this bookkeeper spends $600 on a computer every two years, which breaks down to about $25 a month.

Continued Education

It’s important to keep up with the technology trends and to be knowledgeable in the bookkeeping field. Bookkeepers aren’t required to have any outside certifications or credits, but it is helpful to always be growing yourself in your field. Maybe you decide to take one class per year at $300, which would break down to $25 a month.

Website and domain name

I created my website on Wix, and it is $17 a month to host it there, so that’s what I’m budgeting for this example. You can hire it out and have someone build it for you or host it for you, so the budget may look slightly different based on what you prefer to do.

Business license and business email

Depending on what state you live in, the cost for a business license can vary. In Oregon, for example, it is $150 annually to file a business license, which budgets to $12.50 per month.

You could use your personal email at least at the beginning, but it is nice to separate business from personal at some point. A business email is relatively inexpensive at $6 a month.

Home office

I usually figure out my home office expenses at the end of the year with my accountant. In order to know what your home office “expense” is, you would take the total square footage of your home and deduct the square footage of your designated office.

If you don’t have an office just for business, then usually this isn’t something you would be able to write off, but it’s best to work with your accountant on this particular expense. I didn’t put that directly into the budget because it is more of a deduction than an expense. You already have your home, so you’re not paying for the office each month directly.

Health Insurance

Personally, our health insurance goes through my husband’s employment, so I don’t pay anything for that through my business. However, that is something to consider as a contractor, and that is a fairly significant expense each month.

RELATED: Start Your Bookkeeping Business in 30 Days

Overall Picture of Monthly & Annual Bookkeeper Expenses

With the example I’ve been working with today, the total expenses are $767 per month, which sums to $8,736 annually.

What’s this bookkeeper’s monthly profit in this scenario?

Her monthly income is $4,050, and her monthly expenses are $767, which leaves her with a net profit of $3,284.

For working half-time, I feel like this is a pretty good take on monthly income, and I did end up dividing it by the amount of hours you would be working, and it came out to about $41 an hour, which is a decent hourly wage.

As an equivalent, $41 an hour is around $82,000 per year if you were working full time. Now, in this example, the bookkeeper is only working part time and making half of that, but it’s nice to see what the income relates to. This gives you an idea of the value of a bookkeeper!

The more you specialize in a niche and are desired in that specific area, the more valuable you become and the more you can charge. You could also just plan to spend less each month so you are keeping more of your income. Find the balance of deducting enough expenses but not spending on unnecessary things.

When I first started, I wanted to keep my expenses so low so I’d have the biggest profit margin, but then I realized if I am paying for the internet or my phone anyway, I should be deducting it as a business expense. This helps business owners in the long run keep more of their income.

And, don’t forget that some of your income will be given over to taxes, so you’ll want to check in with your own state and the tax laws to know what you need to set aside for tax time.

Related: Explained: Do You Need to Pay Quarterly Taxes - and How Much?