What does a bookkeeper do?

One question I get all the time is, “What exactly does a bookkeeper do?”

Sometimes there is confusion between what a bookkeeper does and what an accountant’s role is, and even though the two complement each other, their tasks and responsibilities are quite different.

The main role of bookkeepers is to categorize expenses and income for their clients. Some of the other responsibilities are al-a-carte based on client needs and what services the bookkeeper is willing to provide, including invoicing and bill pay.

Click HERE to watch the video, or keep reading to learn more!

How to Categorize Expenses and Income

Categorizing expenses and income for clients is the meat of a bookkeeper’s role. This is a daunting task that a business owner has to think about, which is why many choose to hire a bookkeeper.

At tax time every year, the IRS wants to know how you’re spending your money. They want to see the breakdown of how much a business spends in different categories, including meals, utilities, wages for your employees, and the list goes on. The IRS will ask for the dollar amount for each of those things, and it’s important for business owners to be specific and thorough in their bookkeeping.

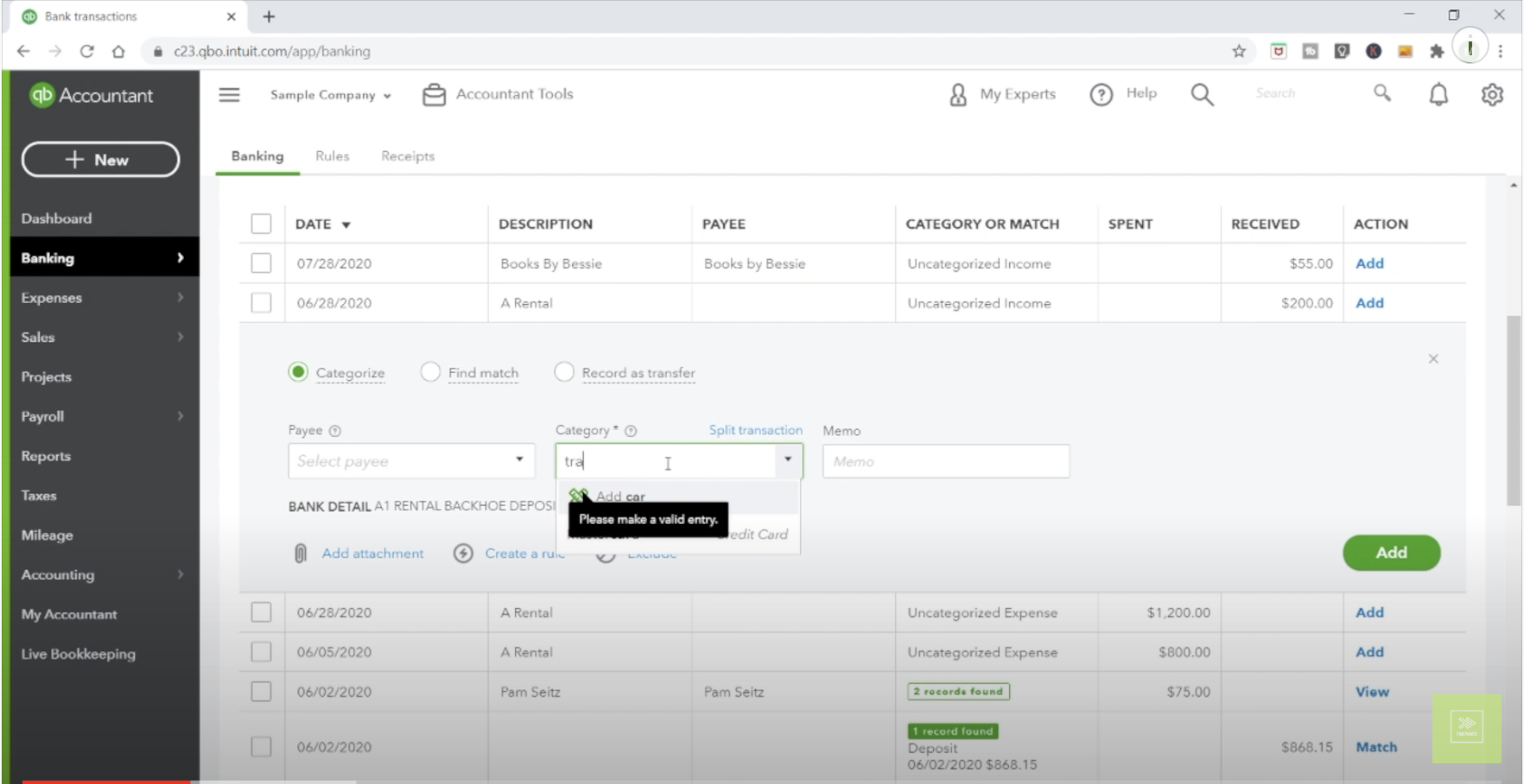

As a bookkeeper, you can link your client’s bank account and credit card (or multiples of each) to QuickBooks Online or QuickBooks Desktop--I prefer the online version. Once you have everything set up for your client, you, as the bookkeeper, will go in and categorize each item.

It’s important for business owners to have all their expenses categorized correctly so they know exactly where they are spending their money. It’s simple for you to create those categories for your clients in the Chart of Accounts. In Quickbooks, you will find it through the “Accounting” tab on the left menu. Once in there, you will see quite a few pre-filled categories already, but you may need to customize them based on your client’s business needs.

Another thing you will be responsible for is reconciling all the bank accounts at the end of the month. You’ll take a look at the bank statement and see how much the bank thinks there should be in the account, and compare it to what is in QuickBooks. You’ll make sure they are equal and there are no discrepancies.

What is the Role of Accounts Payable?

What does accounts payable mean as a bookkeeper? It means you help your clients pay their bills.

Accounts payable is anything your client needs to be paying out. Some examples would be paying vendors for materials, taking care of their utilities, or rent. As a bookkeeper, you can take care of paying the bills for your clients to help them keep organized.

There are quite a few different systems that are effective for bill pay and organization. You can come up with a paperless online option, use a service like Bill Pay, or create a paper system where the client gets the bill in the mail, signs off on it, and then you as the bookkeeper would go into QuickBooks, register it, and send a check by mail. The different systems are determined by your clients’ preferences, your preferences, and the type of businesses they have.

What is Accounts Receivable?

Any money that your client is receiving for his products or services is considered accounts receivable. This is most often captured in invoices.

If your client is a doctor, lawyer, or contractor (for example), they will send an invoice for any services given. You as the bookkeeper will be responsible for sending those invoices out, which you can do online through QuickBooks, or you can send through the mail.

Within QuickBooks you can easily track how much money you have going out and how much is coming in. When someone pays you, you need to apply that to the invoice so your client knows it’s paid, and then send some type of receipt to the sender so they know the money was received.

Can a Bookkeeper Do Payroll?

There are a few different ways you can work through payroll as a bookkeeper, but this is probably one of the most complicated parts of the bookkeeping process.

QuickBooks has a section that you can manually insert all the taxes, information, and deductions for each employee’s paycheck and then print those out, or you can do an electronic version of that.

What I’ve found becoming more common and popular, and what I do as a bookkeeper, is that my client will hire a payroll company that specializes in payroll--because there are quite a few of specific laws and rules, deductions, and insurance that are constantly changing, and it’s not something that I want to have to keep up with.

For a fairly reasonable rate, you can get a payroll company to do that portion of the work, and what you would do as the bookkeeper, is communicate with the payroll company and tell them the hours worked for each employee. From there, you will get a report form the payroll company that tells you how to enter the information into QuickBooks. There will be different line items for different types of taxes and different types of insurance.

Payroll is a little more complex than just imputing how much an employee made into the system, and that is why many business owners choose to go the route of having a bookkeeper (or payroll company) take care of their payroll, rather than doing it themselves.

Steps to Prepare Monthly Financial Statements

As a bookkeeper, you are putting all of your clients’ transactions into different categories, so one of the most important tasks for you is to ensure it is organized in a way that the business owner can read it, understand it, and use it as a tool for managing their business well.

The most common report in QuickBooks is the profit and loss report, which will first list all the income coming in, next all the expenses going out, and lastly the business owner’s net profit.

Every single month, around the 6th of the month you will want to run this report for your client. It’s important to wait until around the 6th of the month because it takes a little while for the bank to close the previous month and have the updated information ready to download in the profit and loss report.

This process can be very specialized depending on your clients and what you think will be helpful for them, but one thing I like to do is to have the previous month’s income so they can see what they made and then compare it to the yearly income-to-date total as well. There are tons of settings you can play with to give the most useful information to your clients.

Other reports you could send to your clients are the outstanding invoices, as well as a balance sheet that shows all the assets and liabilities the company has.

What are Year-End Reporting Procedures?

The last of the different bookkeeping rolls includes a year-end report. This report is what the client’s accountant needs at tax time.

Sometimes this is a bit confusing because bookkeepers don’t necessarily do taxes because you have to have a special certification and special schooling in order to be a tax preparer.

Many accountants are tax preparers, so as a bookkeeper, I always partner with my client’s accountant at tax time. During tax time, I will send the accountant a year-end profit and loss statement, a balance sheet, and any other information that the accountant needs. Sometimes the accountant has special requests, such as large purchases that need to be depreciated.

If you think becoming a bookkeeper sounds interesting to you, knowing the first steps in the process may be helpful!

You can also register for my free Beginner Bookkeeping Masterclass that will help you determine if bookkeeping is right for you.

What parts of the bookkeeping career are appealing to you? Which of the add-on features do you think you’d want to offer to clients?